Trump’s crypto cheer lifts Bitcoin, but core risks still loom

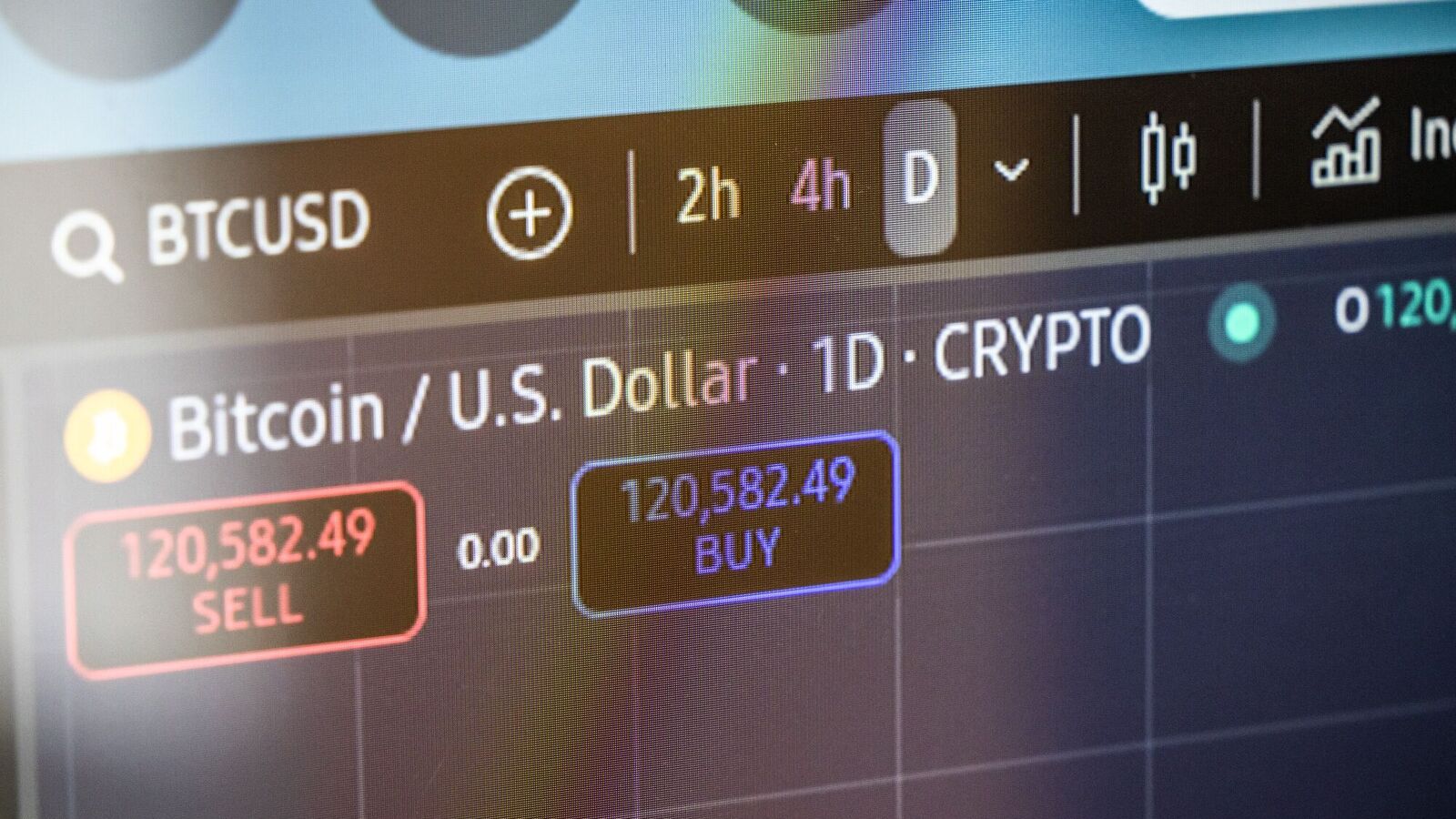

The cryptocurrency faithful are having quite a moment. Donald Trump’s return to the White House has brought a veritable cornucopia of pro-crypto promises, from talk of a “Strategic Bitcoin Reserve” to declarations about making America the “crypto capital of the world.” Markets have reacted predictably: Bitcoin has surged past previous highs, and believers are treating this as ultimate vindication.

Yet beneath the sheen of political legitimacy, nothing fundamental has changed about cryptocurrencies’ essential nature.

The irony in Trump’s embrace of crypto is hard to miss. The proposed “Strategic Bitcoin Reserve and US Digital Asset Stockpile” will apparently consist entirely of assets seized from criminals. In other words, the US government’s official cryptocurrency holdings will be digital assets once used for ransomware, money laundering, drug trafficking, and other illicit activities. It’s rather like announcing a strategic reserve of stolen goods as proof of their virtue.

This detail neatly captures crypto’s central problem. Despite all the technological sophistication and political endorsements, it remains the payment method of choice for criminals worldwide. Every major ransomware attack, dark web marketplace, and cross-border money laundering network gravitates to crypto for the same reasons enthusiasts celebrate it—anonymity, irreversibility, and freedom from traditional oversight.

Political enthusiasm can’t fix these structural flaws. Governments seeking to legitimise crypto are, in effect, blessing a system designed to bypass governmental authority. The contradiction is glaring: regulators tout an asset class while acknowledging that their strategic reserves will be filled mainly by seizing it from criminals.

The ease with which fraud and theft occur in crypto remains staggering. Consider the “socialised loss” strategy, where a major Indian exchange, after losing customer funds to hackers, decided everyone should share the pain, a perfect example of the Wild West ethos. When exchanges profit, it’s capitalism; when they’re robbed, suddenly everyone’s a socialist. The frequency of such episodes would be comical if they didn’t wipe out life savings.

These aren’t isolated mishaps or growing pains; they’re built into a system that operates outside traditional financial protections. When a bank is robbed, deposit insurance protects you. When a crypto exchange is “hacked”, often a euphemism, you’re on your own. The very decentralisation crypto champions means there’s no safety net when things go wrong.

Trump’s enthusiasm also underlines another uncomfortable reality: an anti-establishment movement has been fully co-opted by the establishment it once vowed to disrupt. Wall Street, which Bitcoin was meant to circumvent, is now its biggest backer via ETFs and institutional products. The so-called revolutionary currency depends on the same traditional finance for its legitimacy.

Political endorsement carries psychological weight. When governments and big institutions adopt a position, it creates an illusion of safety and permanence. Past crypto bubbles fed on tech mystique and get-rich-quick dreams; this cycle adds political validation, which could make it more dangerous for ordinary investors mistaking political backing for sound investment.

For Indian investors, the temptation to chase this apparent legitimacy will be strong. Domestic taxation has curbed much local speculation, but political developments in the US could encourage some to seek workarounds. The “don’t miss out” narrative, wrapped in patriotic American rhetoric about financial dominance, could be persuasive.

Yet the math hasn’t changed. Crypto produces nothing, earns nothing, and represents no underlying asset. It serves no economic purpose that existing systems can’t fulfil more efficiently. Its price is driven purely by speculative sentiment, whether fuelled by tech hype, celebrity endorsements, or presidential tweets.

The most telling part of crypto’s political embrace is how quickly its advocates abandoned anti-government principles in exchange for government approval. Those who once railed against fiat currencies and central banks now cheer politicians promising to hoard their preferred tokens. It’s a striking shift from revolutionary idealism to conventional rent-seeking.

Short-term price predictions are futile, speculative bubbles can inflate far beyond reason. But knowing what you’re buying matters. Political theatre and presidential applause can’t turn speculation into investment, gambling into wealth-building, or criminal infrastructure into legitimate finance. However much hot air gets pumped into this bubble, the fundamentals remain unchanged.

Dhirendra Kumar is founder and chief executive officer of Value Research, an independent advisory firm. Views expressed are personal.